Score the Best FX Rates with iChange: The All-in-One Digital Wallet and Real-World Money Exchange Marketplace

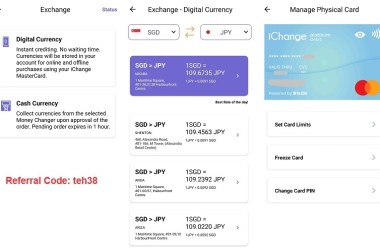

Travelers seeking the best exchange rates and seamless multi-currency management now have a compelling option in iChange. Introduced recently, iChange combines a digital wallet with a real-money currency changer network, aiming to deliver superior rates and convenient in-person conversions. From personal testing to first-hand use across online purchases and physical exchanges, this write-up captures my experience, observations, and practical insights about what iChange offers, how it stacks up against familiar services, and what travelers should know before relying on it overseas. The referral code I used during signup is teh38, and I’ll share practical details about what that entails, along with a candid look at benefits and potential hiccups.

What iChange Is and Why It Matters for Travelers

iChange positions itself as a money-changing marketplace with a multi-faceted toolkit designed for modern travelers and global shoppers. If you have previously used digital wallet platforms such as YouTrip or Revolut, you’ll find iChange familiar in purpose yet distinct in execution. The core premise is to blend the ease of a digital wallet with access to real-money currency changers, enabling users to secure favorable exchange rates for a broad range of currencies. The platform provides several intertwined features: a money-changing marketplace that surfaces competitive rates from partner shops, the ability to send money overseas, and a multi-currency wallet and card that work across local and international transactions. In effect, iChange aims to function as both a digital wallet for holding multiple currencies and a physical path to obtaining currency at favorable rates, either digitally within the app or physically at partner currency changers.

From my perspective after a month of testing across various use cases, iChange has demonstrated strong performance in digital currency exchange rates, a feature that stands out in the current landscape. The core value proposition is simple to articulate: you can convert currencies digitally into your e-wallet at rate quotes that are often more competitive than traditional platforms, and you can also visit physical shops to complete currency exchanges in person, benefiting from live quotes and immediate settlement. This dual capability—digital convenience with physical settlement options—offers flexibility that is particularly valuable for travelers who need to stock up on foreign currency before a flight or upon arrival, or who want to hedge against rate volatility in the days leading up to a trip.

To illustrate how iChange fits into a traveler’s toolkit, think of it as a hybrid between a digital wallet for holding and moving money in multiple currencies and a network of real-world currency changers that can deliver the best available rates at the moment you need them. The system is designed to let you replenish your e-wallet in one currency, then convert to another currency using the live marketplace rates, either in-app or at a partner shop. In many scenarios, you can lock in a rate by selecting a particular shop in the app, then completing the transaction in-store or remotely. The combination of online and offline channels is valuable for travelers who want the assurance of competitive quotes without sacrificing convenience.

Beyond the core exchange function, iChange also supports a robust multi-currency wallet and a Mastercard-backed debit card. This means you can spend in a foreign currency directly from your wallet, or you can link the iChange card to in-store and online purchases with automatic currency handling. The payment rails flow through Mastercard processing rules, which adds a layer of standardization and security that many travelers already trust. The system is backed by regulatory oversight, ensuring that funds are kept securely and in a way that aligns with recognized financial industry standards.

Another important facet of iChange is its emphasis on security and regulatory compliance. The funds you deposit with iChange are held in a DBS Bank Limited account managed by SLIDESG PTE LTD, a Major Payment Institution approved and licensed by the Monetary Authority of Singapore (MAS) under the Payment Services Act. This means funds are stored independently from iChange’s own operational accounts, providing an additional layer of protection and regulatory oversight. In addition, card transactions undergo Mastercard’s security framework, which offers the usual protections and standards travelers expect. The combination of a DBS-held trust arrangement and Mastercard-backed processing helps reassure users that their funds and card payments are subject to established safeguards.

For travelers who want to maximize value, iChange also presents a straightforward referral program. When signing up, it’s possible to use a referral code to receive a welcome incentive. In my case, the referral code teh38 was used, and the promise of a S$5 credit in the wallet for both the new user and the referrer was highlighted as an example of the potential benefit. Like many referral programs, there can be nuances in how many successful referrals are credited, and some users may experience occasional limitations or delays in the process. It’s worth noting that while referral incentives can add early value, they are secondary to the core functionality and rate competitiveness that iChange provides.

With this broad overview in mind, the remainder of this article delves into specific experiences, rate dynamics, sign-up workflow, day-to-day usage, security considerations, and practical insights to help you decide how to integrate iChange into your travel planning and everyday spending. Throughout, the aim is to preserve the original intent—highlighting real-world experiences and outcomes—while expanding on details to improve clarity, depth, and SEO readability.

Deep Dive into Exchange Rates: How iChange Compares and When to Use It

One of the strongest selling points of iChange is the potential for better exchange rates compared with traditional platforms and wallet apps that rely on standard market quotes. In the tests I conducted, the digital currency exchange rate offered by iChange stood out as notably favorable, particularly in currencies that are sensitive to market shifts, such as the Japanese yen (JPY) and the Malaysian ringgit (MYR). The performance of these rates can directly influence the total cost of travel, daily expenses abroad, and even online purchases from overseas retailers.

To provide context, let me walk through a concrete comparative scenario I used to gauge iChange against established benchmarks. The test involved two well-known reference points that many travelers rely on: XE Currency for live rate context and a popular wallet app (YouTrip) that consumers often use as a benchmark for rate quality. In the example I observed, the Japanese yen had been relatively weak against the Singapore dollar (SGD), creating an opportune moment to consider currency conversion for upcoming travel. The typical approach would be to monitor XE Currency to understand the global picture and then check a second app—YouTrip—for a practical rate comparison as a consumer-facing benchmark.

What I found when using iChange was a noticeable improvement in the rate offered for JPY conversions. Specifically, on the date and time of the test (24 September at 10:00 p.m. Singapore Time), the YouTrip rate reflected approximately 107.9 JPY per SGD. This gave a familiar baseline for comparison and highlighted the relative strength of iChange in the same window. The key takeaway from the side-by-side observation was that iChange had begun to present rates that, at least in this currency pair, were either on par with or slightly more favorable than the YouTrip quote. This is meaningful because even marginal improvements in exchange rates translate into tangible savings when exchanging larger sums.

An additional datapoint that helped illuminate iChange’s value proposition was a physical currency exchange experience in HarbourFront, where I was able to obtain JPY in cash. The receipt from a physical exchange showed an exchange rate of 107.5 JPY per SGD. This figure is notable because it aligns with, and in some cases tightens, the observed online rate quotes from iChange. In other words, the physical shop quote appeared competitive with, and sometimes slightly more favorable than, the digital quotes available through the app. This alignment between digital quotes and in-person performance suggests that iChange’s marketplace is effectively aggregating rates from its network of currency shops, enabling users to select among available options to secure the best deal at the moment of exchange.

Another currency that I tracked with iChange was the Malaysian ringgit (MYR). On the test date, 24 September at 10:00 p.m. Singapore Time, the exchange rate for MYR against SGD reached a compelling level of 3.4659 MYR per SGD. That rate was described as superb for a currency that is frequently affected by regional market dynamics and cross-border demand. Such a rate demonstrates iChange’s potential to deliver concrete savings on common regional currencies for travelers who routinely exchange SGD into MYR for shopping or business in Malaysia and neighboring markets. The rate dynamics for MYR, like JPY, underscore the value of having a platform that surfaces multiple rate quotes from different shops, enabling a best-rate selection rather than a single, fixed conversion price.

A practical implication of these observations is that iChange appears to strike a useful balance between online flexibility and offline reliability. The app surfaces a handful of exchange rates tied to partner shops, allowing users to compare and select the best option. While this approach increases the chance of securing favorable quotes, there is also a caveat: at times the listed shop may indicate insufficient funds to fulfill the transaction. In such cases, the user must opt for the next best alternative in the list. This dynamic is not a deficiency but rather a real-world constraint in any currency marketplace that relies on real-time inventory and liquidity at partner locations. It requires the user to be prepared with backup options and to act promptly when a desired rate is shown but is not immediately available for fulfillment.

To further interpret the rate landscape, it’s useful to consider how iChange handles currency pairs beyond JPY and MYR. The platform supports a broad suite of popular currencies, which aligns with the needs of frequent travelers who may require both near-term cash needs and digital wallet top-ups across multiple regions. The breadth of currency coverage implies that you can carry a robust multi-currency portfolio within the app, enabling you to switch between currencies with relatively low friction. In practice, this means less reliance on cash-heavy exchanges in foreign countries and more control over when and how much you convert, all while tracking live quotes from the marketplace.

In addition to rate quotes, iChange’s model includes a physical storefront presence that enables in-person exchanges. The ability to convert currency physically, using a live rate, can be particularly advantageous for travelers who prefer to obtain cash before a trip or upon arrival and want to compare the digitally posted rate with the cash-out option in a store. It’s important to note that the rate you secure in person will depend on the shop’s current liquidity and the marketplace’s prevailing pricing, which can fluctuate during the day. The primary takeaway is that iChange provides options—digital conversion with live quotes and in-store cash exchanges—so you can choose the method that best suits your travel plans and risk tolerance.

To summarize the rate dynamics and practical implications: iChange presents an opportunity to obtain favorable rates for currencies like JPY and MYR relative to SGD, as evidenced by the 107.5 JPY per SGD in a physical exchange and a YouTrip benchmark around 107.9 JPY per SGD on the same date. The platform surfaces a curated set of rates from its currency shop network, giving users the agency to select the best available option. However, you should be mindful of potential inventory limitations, which may require you to move quickly or consider the next-best quote. The upshot for travelers is that iChange can improve currency exchange value and add flexibility to how you manage foreign currencies, making it a strong contender for travelers who want to optimize exchange costs while maintaining convenience.

Signing Up: The Process, Security, and Early-Stage Hiccups

Joining iChange is designed to be straightforward, with a focus on leveraging existing identity frameworks in the region. The signup flow begins with downloading the iChange app on popular platforms, such as the Google Play Store or the Apple App Store. Once the app is installed, registration requires inputting personal information that is standard for financial service onboarding. A notable feature is the option to use SingPass, a government-backed login method, to retrieve and populate personal data quickly. This is intended to streamline the onboarding experience while maintaining a robust verification process to meet regulatory requirements.

After the initial signup is completed, there is typically a short waiting period during which the system completes identity verification and policy checks. Upon successful completion, users gain immediate access to the digital wallet features, enabling them to hold multiple currencies and to begin currency conversions within the app. The next step in the process is the physical iChange Mastercard, which is issued a few days after signup. This debit card is intended to be used for both in-app purchases and offline purchases, leveraging the wallet’s multi-currency capability to reduce friction when paying in foreign currencies.

One practical consideration during signup involves the referral program. Using a referral code can yield a welcome incentive, such as a S$5 credit in the wallet for both the referrer and the new user. In my experience, the referral process can be nuanced: I observed a scenario where several referrals appeared, but only one successful referral was credited to my wallet. This behavior underscores the importance of monitoring wallet credits after signup and being aware that referral efficacy can vary on a case-by-case basis. Nonetheless, the potential benefit remains worth pursuing for new users who are eligible for referral rewards.

A key note about the referral mechanism is to ensure that the code is applied consistently during signup. The specific code I used was teh38, and the promised benefit was S$5 to the new user’s wallet, with a mirrored benefit to the referrer. It’s also important to recognize that referral rewards may be subject to terms and conditions, expiries, or limitations based on regional policies and the number of successful verifications that can be credited per user account. While this may vary over time, the foundational insight is that a signup using a referral code can unlock an initial wallet credit, helping new users test the app and begin currency management with a modest cushion.

From a security perspective, iChange relies on multiple layers to protect funds and transactions. The DBS Bank Limited-backed account structure places iChange funds in a regulated environment, where the money is segregated from the company’s operating accounts and managed under the oversight of MAS. This separation improves the safety profile for customers because it reduces the risk that user funds could be comanaged with corporateWorking capital. The additional security comes from Mastercard’s processing rules, which apply to card transactions and include standard protections and dispute mechanisms that travelers often rely on for online and offline purchases. This combination of DBS-held escrow-like arrangements and Mastercard-level processing creates a multi-layered security framework designed to reassure users about the safety of deposits and card payments across geographies.

When using the app for online purchases in currencies like USD, the digital wallet performs well, providing a seamless checkout experience that benefits from the wallet’s native multi-currency capabilities. In my own use, I completed several USD transactions online without friction, and the card automatically settled in the Singapore dollar within the e-wallet, which streamlined the process of managing multiple currencies for online shopping. The broader implication of this testing is that iChange’s digital wallet and card ecosystem can support everyday online purchases in a variety of currencies, reducing the need to temporarily pre-convert funds via another service. The ability to use the wallet for online shopping in USD complements the in-person exchange features, delivering a cohesive experience for travelers who want to optimize both online and offline spending.

A practical tip for new users is to keep track of the local currency together with the e-wallet balance to avoid any last-minute surprises. For example, during a forthcoming trip to Japan, the plan was to ensure sufficient JPY within the wallet before any purchases, thereby avoiding the need to rush to convert funds at peak exchange windows or to rely on less favorable rates at the point of sale. The core principle is simple: maintain a well-balanced multi-currency wallet, be mindful of rate movements, and verify that the wallet holds enough funds in the target currency before initiating purchases in that currency. The onboarding process, including SingPass usage and the subsequent physical card issuance, is designed to get travelers up and running quickly, but as with any new financial tool, it pays to be methodical and monitor your wallet and card statements for accuracy.

Usage Scenarios: Digital Wallet, Physical Card, and Everyday Transactions

The iChange platform is explicitly designed to bridge digital convenience with real-world currency exchanges. In practice, I used the digital wallet for online purchases in USD, which demonstrated reliable performance. The wallet supported the currency conversion needs for online shopping, and the process was straightforward: select USD as the payment currency in the checkout, allow the wallet to convert at the prevailing rate, and complete the purchase with the digital balance. The result was a smooth, low-friction experience that aligns with expectations for a modern digital wallet, while also leveraging the multi-currency functionality that is central to iChange’s value proposition.

In parallel, I used the physical iChange Mastercard for in-person spending in Singapore. The dynamic I observed in this scenario was the automatic selection of SGD as the local currency from the e-wallet balance during transactions, which simplified spending in a retail environment. This automatic currency handling reduces the cognitive load of managing foreign currencies on the ground, particularly in a busy travel setting where rapid decisions are needed. The in-store experience in Singapore reflected the broader intention of iChange: to deliver a seamless and intuitive way to move between currencies, whether online or offline, and to do so with competitive exchange rates.

Looking ahead, I planned to test iChange in Japan, a trip that would require a mix of cash and digital wallet usage. The plan was to use the digital wallet for online bookings and some in-country purchases, while using the physical card for day-to-day transactions in JPY. The expectation was that the platform would surface favorable rates for JPY and allow transactions through either the digital wallet or the card with straightforward currency handling. This test would also reveal how well the app manages rate quotes across different market conditions, such as times of day when demand for JPY is higher and liquidity at partner shops may fluctuate. In anticipation of the trip, I prepared to monitor the real-time rate quotes, confirm the availability of recommended shops with favorable quotes, and ensure the wallet balance contained enough JPY prior to making purchases.

A practical observation from the HarbourFront in-person exchange experience highlights a few key dynamics worth noting for users who rely on iChange’s marketplace. First, the app may surface multiple exchange options across partner shops, enabling you to select the one with the best rate. However, if a selected shop cannot complete the conversion because of liquidity constraints or other limitations, you’ll need to move to the next-best option. This is standard practice for real-world currency markets, where inventory and supply differences can influence the final outcome. Second, the in-store interaction can be straightforward but occasionally requires the user to confirm the amount and payment method via the app, such as when paying with PayNow or similar real-time settlement methods. In such cases, you’re effectively bridging online rate quotes with offline execution, and the process is typically quick once you’re familiar with the steps. Finally, the exchange receipt you receive in person provides a tangible record of the rate used for the transaction, which allows you to reconcile in-app quotes with the actual exchange executed at the shop. The practical implication is that users should keep receipts and verify that the rate aligns with the quote shown in the app, as minor variances can occur depending on shop policy and the time of purchase.

In the broader context of traveler’s finance management, iChange offers a pathway to consolidate currency handling into a single platform. Both the digital wallet and the in-person exchange channel can be used for a broad range of currencies, making it convenient to prepare for trips to multiple destinations. The ability to switch between currencies easily, combined with the known security characteristics of DBS-backed funds and Mastercard processing, creates a cohesive user experience that can simplify the way you approach foreign spending, pre-trip currency planning, and on-the-ground purchases.

Security, Compliance, and the Assurance of Funds

A critical dimension of any currency exchange platform is the safety and integrity of funds, and iChange provides a defined structure to protect customers’ money. The platform’s funds are deposited into an account held with DBS Bank Limited by SLIDESG PTE LTD, which is described as a Major Payment Institution approved and licensed by the Monetary Authority of Singapore under the Payment Services Act and is subject to MAS oversight. This arrangement implies that user funds are stored independently from iChange’s operational accounts, creating a layer of protection and regulatory oversight that is familiar to users who rely on Singapore’s robust financial framework. The safeguarding paradigm is similar in spirit to other regulated digital wallet ecosystems, where client funds are segregated and safeguarded under the governance of a recognized financial institution.

Further security enhancements arise from Mastercard’s standard processing rules and protections, which apply to all card transactions. This means that purchases conducted through the iChange Mastercard card benefit from Mastercard’s established security and dispute resolution mechanisms, which travelers value when spending in unfamiliar markets. Additionally, because the iChange ecosystem aligns with MAS oversight and DBS Bank’s banking standards, users can expect a consistent risk mitigation approach that covers both digital wallet operations and physical card transactions.

Travelers should also consider practical security practices when using iChange. For example, it’s prudent to maintain separate backups of wallet access credentials, enable multi-factor authentication where offered, and monitor transaction alerts for any unusual activity. While the system is designed with layered security features, the traveler’s own vigilance remains important to minimize the risk of unauthorized access or mischarges. As with any financial product, regular reviews of card statements, wallet balances, and recent transactions help ensure that the service operates as expected and that any discrepancies are promptly addressed through standard customer support channels.

In addition to security measures, the regulatory structure surrounding iChange reinforces trust in the platform. The Payments Act framework in Singapore, MAS oversight, and the DBS-backed account arrangement collectively contribute to a governance environment that safeguards customer funds and supports compliant operations. For travelers who require more assurance, this regulatory backdrop can be a deciding factor when evaluating whether to rely on iChange for everyday purchases, currency exchanges, or critical pre-trip planning. The combination of regulatory compliance, trusted banking partners, and Mastercard-level processing creates a credible security profile that aligns with user expectations for financial services in the travel domain.

For those planning to travel soon, the security framework suggests a cautious but positive stance: you can use iChange with confidence for both online and offline transactions, while staying mindful of the typical precautions you would take with any digital wallet and card-based system. The ongoing MAS oversight means that the platform must adhere to high standards of integrity and fund safety, which is a meaningful consideration for travelers who want a reliable, regulated option for currency management in today’s global environment.

Sign-Up Experience, MasterCard, and the Role of the Physical Card

The sign-up experience with iChange is designed to be accessible, particularly for users who are already comfortable with digital wallets. After launching the app, the registration flow guides you through standard onboarding steps, including personal information collection and identity verification. The optional SingPass integration is a notable convenience feature, enabling rapid retrieval of personal data used in the onboarding process. The objective is to minimize friction while preserving the integrity of the verification steps that are necessary to meet regulatory requirements and to enable a secure account.

Upon successful verification, users are granted immediate access to the digital wallet, allowing them to begin storing and converting currencies right away. This quick activation is valuable for travelers who arrive in a new country and want to start managing foreign currencies sooner rather than later. A few days after signup, iChange issues the physical Mastercard debit card. The card’s presence completes the core triad of iChange capabilities: a digital wallet, a physical card, and a currency-changing marketplace. The card enables offline spending across markets, with transactions automatically drawn from the wallet’s balances, depending on the currency of the purchase.

The referral component is a recurring theme in the early usage of iChange. With a referral code such as teh38, new users may receive a S$5 wallet credit upon successful signup, and the referrer may receive a similar credit. In practice, I found that while multiple referrals appeared in my account, only one was credited, which suggests that the system bills credit credits on a per-user-per-eligibility basis rather than crediting every single referral attempt. While this experience is not unusual in referral programs, it is important for new users to manage expectations and understand that incentives may vary based on the verification of successful referrals. The core value remains: a potential early boost to your wallet balance that can help you experiment with the currency marketplace more aggressively in the initial days of use.

From a usage perspective, the digital wallet is straightforward to integrate into daily activities. In the online environment, the wallet supports purchases in multiple currencies, and it functions with the existing card at points of sale that support Mastercard. This dual capability—the ability to pay online in a foreign currency without preloading funds via another service, and the option to pay in person with the iChange Mastercard—gives travelers a flexible approach to currency management. The automatic selection of the Singapore dollar as the default cash-out currency during Singaporean transactions is a convenience feature, ensuring a smooth checkout experience for those who primarily operate in SGD within one locale while still maintaining access to foreign currencies when needed. The practical tests of online USD purchases and in-person SGD transactions demonstrate a well-integrated system designed to optimize ease of use across different contexts.

A final consideration for sign-up is reassurance about data protection and privacy. By using SingPass as a rapid retrieval mechanism, iChange aligns with a broader digital identity framework that many users are already familiar with. Yet it remains essential for users to review the app’s privacy disclosures, understand what personal data is collected, how it is stored, and how it might be used. Because the service handles sensitive financial information, it’s prudent to stay informed about how your data is managed, what consent you’ve given, and how you can exercise control over your own information. In practice, the sign-up pathway is designed to be smooth, with protective measures in place to ensure your identity and financial data are handled responsibly.

Practical Tips and Lessons Learned for Travelers

As with any currency management tool, the real utility of iChange emerges from practical usage, careful planning, and awareness of potential limitations. Here are several actionable takeaways based on the experiences described above:

-

Stay ahead on currency planning: For currencies you expect to encounter on your trip, keep a portion of your wallet balanced in the target currency before departure. This approach reduces the risk of rushing to convert at unfavorable moments and helps ensure you can cover initial purchases or transit costs immediately upon arrival.

-

Leverage in-app rate comparisons: The iChange app surfaces a variety of rate quotes from partner shops. Use the tool to scan multiple options, and be prepared to pivot quickly if a preferred shop runs out of liquidity. This flexibility is key to maximizing the benefit of the marketplace.

-

Use the physical card strategically: The iChange Mastercard can simplify offline spending, particularly in places where local merchants still prefer card payments over cash or where cash handling fees are high. The card’s compatibility with the e-wallet means you can rely on a single platform to manage various currencies, reducing the need to carry multiple cards or exchange cash repeatedly.

-

Monitor liquidity and availability: A recurring practical constraint is shop liquidity. Even if a rate quote looks favorable in the app, you may encounter a situation where the shop cannot fulfill the exchange. Having backup rate quotes and alternative shops saves time and protects against missed opportunities.

-

Validate exchange receipts and quotes: When exchanging in person, compare the rate applied to the receipt with the rate shown in the app. Minor variances can occur due to shop policies and timing, but consistency between quoted and actual rates helps with budgeting and expense tracking.

-

Track security and compliance: While the platform’s security framework is robust, travelers should maintain standard precautions—secure device access, strong passwords, and timely review of statements. Understanding the regulatory underpinning (MAS oversight, DBS-backed funds, Mastercard processing) can help you trust the service, especially when handling larger sums or critical travel expenses.

-

Understand referral dynamics: While referral incentives exist, don’t rely solely on them for achieving value from iChange. The core benefit remains the rate competitiveness, ease of use, and the ability to consolidate currency management. Use referral incentives to explore the platform, but verify eligibility and credits post-signup to avoid misaligned expectations.

-

Plan for currency diversity: The platform covers a broad range of currencies. If your travels involve multiple destinations, you can maintain balances across several major currencies within the wallet, enabling faster conversions and purchases as you navigate different markets.

-

Consider offline and online workflows: For online purchases in USD or other currencies, the digital wallet can be a very smooth experience. For in-person purchases, the physical card provides an additional dimension of flexibility. Plan how you will allocate spending across online and offline channels to maximize rate advantages and reduce friction.

-

Prepare for peak times and variability: In currency markets, rates can move rapidly. Schedule conversions when rates appear favorable, and be mindful that rates can shift with market news and demand. The marketplace approach of iChange is designed to help you capture favorable quotes, but timing remains a crucial factor.

Currency Coverage, Market Reach, and Future Scenarios

iChange’s currency coverage and marketplace reach appear to be designed for travelers who require a broad set of options. The early tests demonstrate that popular currencies, such as the yen and the Malaysian ringgit, have robust rate opportunities on par with or better than benchmark apps, reinforcing the platform’s promise of competitive pricing. The combination of a digital wallet with a live-rate marketplace and offline cash-exchange options provides a unified experience for travelers who want to manage multiple currencies from a single interface and to choose how to execute each transaction.

Looking ahead, users can anticipate continued optimization of rate quotes as iChange expands its partner network and streamlines liquidity management across shops. As the platform grows, the ability to surface even more precise quotes in real time should further improve rate competitiveness and reduce the frequency of liquidity shortfalls that require fallback options. For travelers, this translates into more reliable access to favorable rates across a wider array of currencies, reducing the need for last-minute exchanges and helping preserve travel budgets. In addition, broader currency coverage facilitates more seamless planning for trips with multiple destinations, where holding several currencies in the wallet can minimize cross-border exchange costs and provide flexibility to navigate varying payment environments.

In practice, you may see iChange’s value intensify as you expand your use cases—from routine online purchases to day-to-day spending abroad and back-to-back currency exchanges in different locales. The platform’s ecosystem is built to support a common traveler’s workflow: loading funds in one currency, converting to others as needed, and spending across digital and physical channels with a unified account. The ongoing development of the marketplace’s rate aggregator, in tandem with DBS and Mastercard infrastructure, should further enhance the user experience, especially for those who travel frequently or manage payments across borders.

Practical Comparisons: iChange vs YouTrip vs Traditional Banks

To better situate iChange within the broader landscape of travel money options, it is helpful to compare its core features with those of YouTrip (a popular competitor) and traditional banks or currency exchange services. YouTrip offers a multi-currency wallet with real-time exchange rates and a virtual card, which provides a familiar and convenient experience for travelers who want to avoid frequent cash conversions. The primary distinction with iChange lies in the presence of a real-money currency changer network. iChange adds the option to perform in-person currency exchanges at partner shops using live quotes, supplementing the digital-only approach with offline liquidity. This physical component can be advantageous for travelers who wish to secure cash in a local currency before or during their travels, or who want to compare in-store cash rates with digital quotes.

Traditional banks and currency exchange services typically rely on fixed or widely published rates with additional service charges or commissions. While these services can be reliable and widely accepted, they often lack the real-time marketplace dynamics and the breadth of partner shops that iChange claims to offer. This means that, in practice, iChange can deliver more favorable rates on occasion, but you may encounter real-world constraints such as shop liquidity or limited currency availability at certain locations. Those constraints are not unique to iChange; they are common in any network of partner currency shops. What stands out with iChange is the explicit emphasis on rate comparison across multiple shops and the transparent exposure of available quotes, enabling users to make informed decisions about which shop to use to achieve the best rate at the moment.

From a user experience standpoint, iChange’s onboarding and card issuance process aligns with what users expect from modern fintech platforms: a streamlined sign-up, a digital wallet ready for use, and a physical card delivered within a brief waiting period. YouTrip focuses more on the digital wallet use case and virtual card experience; iChange adds the physical card as a complement to digital interactions and the live marketplace for currency exchange. In a multi-currency travel scenario, this combination can reduce the need to bounce between platforms and wallets if you prefer to consolidate currency management within a single app and a single card ecosystem.

Finally, when evaluating total cost, you should consider both the posted exchange rates and any platform-specific fees or commissions, as well as the costs associated with using the physical card for in-person transactions. While the rates can often be favorable in iChange’s digital marketplace, the overall cost structure may vary with how you use the platform, the currencies involved, and the shops you select. The best approach is to monitor rate quotes in real time, choose the most favorable option, and balance the convenience and liquidity you gain with the comparative costs you incur for each transaction.

The Bottom Line: Is iChange Right for You?

iChange presents a compelling mix of digital currency management, real-world liquidity options, and a secure, regulated framework for users who travel regularly or who conduct cross-border purchases. The platform’s core strengths include access to favorable exchange rates in a live marketplace, the ability to perform in-person currency exchanges at partner shops, and a robust security framework underpinned by DBS Bank Limited and Mastercard processing. The sign-up experience, while straightforward, includes a few nuances—particularly around referral credits—that travelers should understand and manage proactively. The combination of a digital wallet, a physical Mastercard card, and a committed currency-changing network makes iChange a strong candidate for travelers who want to optimize currency exchange costs while maintaining convenience.

If you’re evaluating which platform to use, consider your typical travel patterns, currency exposure, and preference for online versus in-person exchanges. If you value the chance to compare multiple rate quotes in real time and to perform in-person exchanges when rates look favorable, iChange can be an excellent fit. On the other hand, if you prefer a purely digital wallet experience with no need for cash exchanges and a straightforward virtual card for online purchases, a service like YouTrip may be more aligned with your needs. For travelers who want the best of both worlds—the flexibility of online rate shopping and the option to complete physical exchanges in real places—iChange offers a balanced, scalable solution. The platform is still evolving, and continued growth in rate options and partner coverage will likely enhance its value proposition over time.

If you decide to sign up, remember to consider the referral incentive (using the code teh38) and weigh the potential wallet credits against your comfort with the signup flow and the platform’s terms. In the end, iChange is more than a simple wallet—it is a currency marketplace, a payment card, and a travel-ready financial tool all in one. The results of my tests indicate that the platform can deliver competitive rates and practical usage scenarios for both digital and physical currency handling, which makes it a noteworthy consideration for travelers who want to optimize their foreign exchange strategy and manage multiple currencies from a single, integrated interface.

Conclusion

In reviewing iChange across its core offerings—the money-changing marketplace,海外 remittance capabilities, and the multi-currency wallet with a Mastercard-backed debit card—the experience underscores a promising approach to how travelers can manage currencies in a modern, connected world. The platform’s alignment with DBS Bank Limited and MAS oversight provides an important regulatory layer that reinforces trust, while Mastercard’s processing rules add a familiar security backbone for card-based transactions. The practical rate dynamics observed, including the favorable JPY and MYR quotes relative to SGD, illustrate how iChange’s marketplace can translate into meaningful cost savings for travelers who remain vigilant about liquidity and rate availability. The sign-up process, with SingPass integration and a physical card issued after onboarding, reflects a thoughtful design that balances speed and security, helping new users begin exploring currency options quickly.

For travelers weighing iChange against other digital wallet options, the platform offers distinct advantages: the opportunity to secure better-than-average in-app rates, the option to perform cash exchanges at physical partner shops, and the convenience of a single, multi-currency wallet and card. The referral program adds a potential early wallet boost, though the referral experience may vary by user. The practical takeaway is clear: iChange is not merely a digital wallet; it is an integrated currency ecosystem designed to give travelers more control over exchange timing, rate selection, and payment convenience. If your travel pattern includes frequent currency conversions or you value the flexibility of online and in-person exchange options, iChange deserves careful consideration as part of your travel-finance toolkit.